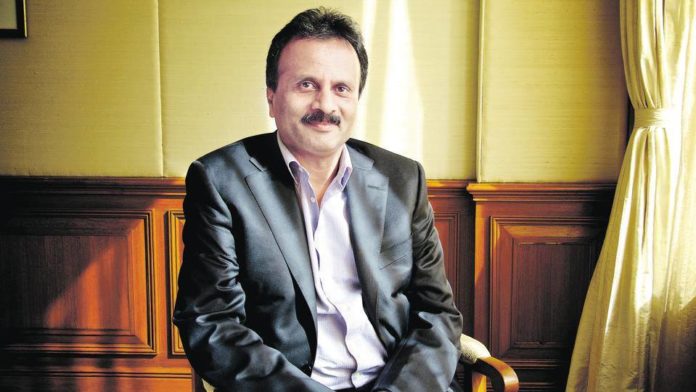

Bengaluru: As Café Coffee Day founder VG Siddhartha’s bloated body washed ashore on the banks of the Netravati river, so did controversies surrounding his financial dealings and suicide.

Like the tag line of CCD which says ‘A lot can happen over coffee,’ a lot of things are happening after the suicide of the Coffee King.

But what led to the final tipping point when Siddhartha took a stroll over the Natravati bridge near Mangaluru may be revealed soon. Undoubtedly there is more than what meets the eye. This is why former Karnataka CM and Congress leader Siddaramaiah called the CCD owner’s death “both disturbing and mysterious.” “The reasons and the invisible hands that ended his life in this tragic way should be unearthed through impartial and fair investigation,” he said.

Whose was that invisible hand? The needle of suspicion is on a private equity partner who exerted tremendous pressure on Siddhartha making his life miserable. Sources say the pressure from the PE partner and recovery agents was so hard that Siddhartha had gone into a shell and was depressed.

The PE firm also prevented Siddhartha from selling his stake in CCD to Coco-Cola. The CCD founder had pinned his hope on this deal to retire a major portion of his debts.

The publicly-listed company’s latest annual report also bears testimony to its rising liabilities and the PE firm. CCD was struggling to repay its debt which topped almost Rs 4,500 crore. Though the group had raised debt from banks, mutual funds and NBFCs among others, Siddhartha’s letter to the board made public Tuesday also points to pressure from a private equity partner to buy-back its holdings in Coffee Day Enterprises. It said the private equity partner exerted pressure on him and his businesses.

The CCD founder also reportedly borrowed Rs 7500 crore from a private financial company in Mumbai on monthly interest. He had reportedly paid Rs 3000 crore, but then ran out of cash. The firm started sending recovery agents to him making is life miserable.

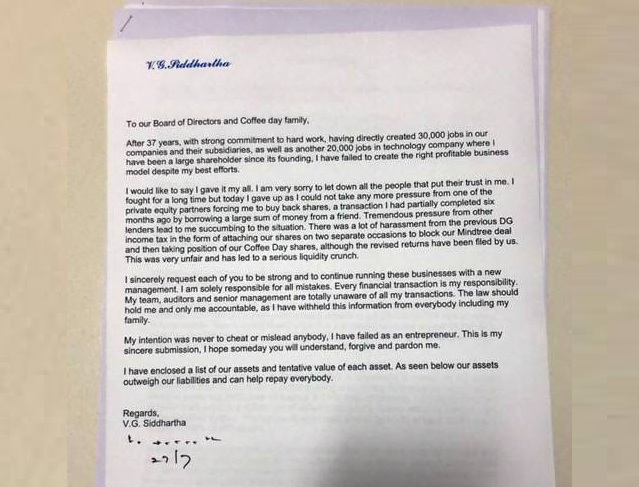

In fact, hours before his disappearance, Siddhartha had called his personal staff at the Cafe Coffee Day head office in Bengaluru and informed them about a letter he had penned to be disseminated as early as possible. The purported letter referred to the “tremendous pressure” he was under from lenders and “harassment” from Income Tax officials. And that he was “very sorry to let down all the people that put their trust in me”.

Police sources said that the July 27 letter that Siddhartha left behind and final conversations he had with a few staff members suggested he was not his usual self. “He told one staff member to look after the interests of the firm after clearing an outstanding loan. He seemed emotional. This was a bit out of character for the businessman,” sources said.

But why did Siddhartha suddenly run out of cash? His woes started two years ago when former minister and senior Congress leader DK Sivakumar’s house and offices were raided by income tax and Enforcement Directorate officials. Sources said that soon after the raid, Sivakumar’s financial manager was arrested. This led to a money trail to Siddhartha.

Incidentally, DKS and Siddhartha are from the same Vokkaliga community. On Wednesday, DKS said he did not want to comment on anything that happened in the past and pleaded for time from prying reporters on his financial links with Siddhartha.

The CCD boss reportedly parked the money of DKS. Then came the arrest of one Rajneesh Gopinath, a Singaporean national. His interrogation by the Income Tax and Enforcement Directorate officials led to his brother Munish Gopinath who is on the board of CCD.

Rajneesh reportedly revealed that Siddhartha had routed unaccounted money through hawala transactions. When the ED dug further, they found that Siddhartha had floated shell companies that showed losses even without an employee on its rolls or doing any business. This led to the suspicion that unaccounted money was being siphoned away from the country for parking.

Amidst all this financial mess, the IT raids also found nearly Rs 130 crore unaccounted cash in his house.

Reacting to Siddhartha’s allegation of harassment by tax authorities in the letter, the department said it acted as per legal provisions. In a press statement, the Office of Principal Chief Commissioner of Income Tax, Karnataka and Goa, Bangalore (B.R. Balakrishnan) said the provisional attachment of shares was made to protect the interests of revenue out of the income admitted by him based on “credible evidence gathered during searches”. The department had attached Mindtree shares held by Siddhartha and Coffee Day which delayed the Larsen and Toubro deal to buy Mindtree. “This was very unfair and has led to a serious liquidity crunch,” Siddhartha’s letter said.

With six subsidiaries and nearly 30 associates and joint ventures, Coffee Day Enterprises’ consolidated debt as on March 2019 stood at over Rs 6,500 crore.

But even as debts kept mounting and crushing him, Coffee Day Enterprises founder continued borrowing, raising as much as Rs 1,500 crore in last six months. Data from the Registrar of Companies shows that capital was raised mostly by pledging shares, but not a rupee was used to retire existing debt. So where did the money go?

Between January and February, 61.31 per cent stake in Tanglin Development was pledged in lieu of Rs 1,015 crore (51 per cent with Axis Trustee for Rs 915 crore and 10.31 per cent with RBL Bank for Rs 100 crore).

In May, another Rs 175 crore was borrowed from Piramal Trusteeship Services. Parallelly, the company tried to retire debts by offloading promoter stake in other entities. But it is unclear where the capital was deployed. Tax officials aren’t ruling out suspicious transactions.

But overall, from Siddhartha’s alleged letter, it is clear that the valuation of the companies he founded far exceeds the overall debt, raising questions about why he resorted to suicide.

The flagship brand Coffee Day Global Ltd alone is valued at Rs 7,000-8,000 crore, which is 3-4 times its current revenue run rate of Rs 2,200 crore. Other subsidiaries including the Coffee Plantations division was valued at Rs 2,000 crore, while timber assets are pegged at another Rs 1,000-1,300 crore. The promoter’s equity stake in Sical Logistics is valued at Rs 1,000-crore, while other subsidiaries, associates and joint ventures including Tanglin Development, Way2Wealth, Ittiam, Magnasoft and Serai are together valued at Rs 5,000 crore.

Another mystery is whether Siddhartha kept his family, especially his father-in-law SM Krishna informed. Nobody knows that.

Some really nice and useful info on this internet site, likewise I believe the design holds great features.